War-related disruptions amplify those pressures. Many central banks, such as the Federal Reserve, had already moved toward tightening monetary policy. Even prior to the war, it surged on the back of soaring commodity prices and supply-demand imbalances. Inflation has become a clear and present danger for many countries. And the divergence that opened up in 2021 between advanced and emerging market and developing economies is expected to persist, suggesting some permanent scarring from the pandemic. Aggregate output for advanced economies will take longer to recover to its pre-pandemic trend. The medium-term outlook is revised downwards for all groups, except commodity exporters who benefit from the surge in energy and food prices. The displacement of about 5 million Ukrainian people to neighbouring countries, especially Poland, Romania, Moldova and Hungary, adds to economic pressures in the region. But the surge in food and fuel prices will hurt lower-income households globally, including in the Americas and the rest of Asia.Įastern Europe and Central Asia have large direct trade and remittance links with Russia and are expected to suffer. Commodity importers in Europe, the Caucasus and Central Asia, the Middle East and North Africa, and sub-Saharan Africa are most affected. Reduced supplies of these commodities have driven their prices up sharply. Russia is a major supplier of oil, gas, and metals, and, together with Ukraine, of wheat and corn. Like seismic waves, its effects will propagate far and wide – through commodity markets, trade, and financial linkages.

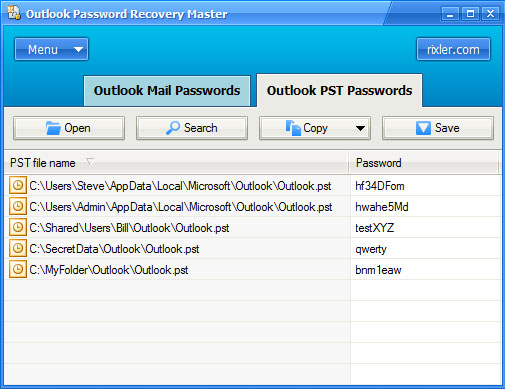

#Outlook password recovery master full series#

The war adds to the series of supply shocks that have struck the global economy in recent years. This year’s growth outlook for the European Union has been revised downward by 1.1 percentage points due to the indirect effects of the war, making it the second-largest contributor to the overall downward revision. This reflects the direct impact of the war on Ukraine and sanctions on Russia, with both countries projected to experience steep contractions. Overall economic risks have risen sharply, and policy tradeoffs have become even more challenging.Ĭompared to our January forecast, we have revised our projection for global growth downwards to 3.6 percent in both 20. In this context, beyond its immediate and tragic humanitarian impact, the war will slow economic growth and increase inflation. The latest lockdowns in China could cause new bottlenecks in global supply chains.

Even before the war, inflation in many countries had been rising due to supply-demand imbalances and policy support during the pandemic, prompting a tightening of monetary policy. This crisis unfolds even as the global economy has not yet fully recovered from the pandemic. Global economic prospects have been severely set back, largely because of Russia’s invasion of Ukraine.

0 kommentar(er)

0 kommentar(er)